Two Templates for Your Convenience

We’ve created TWO resources to help you gain a clear understanding of your financial standing. Whether you're sharing this with an interested party or simply tracking your own finances, try these templates.

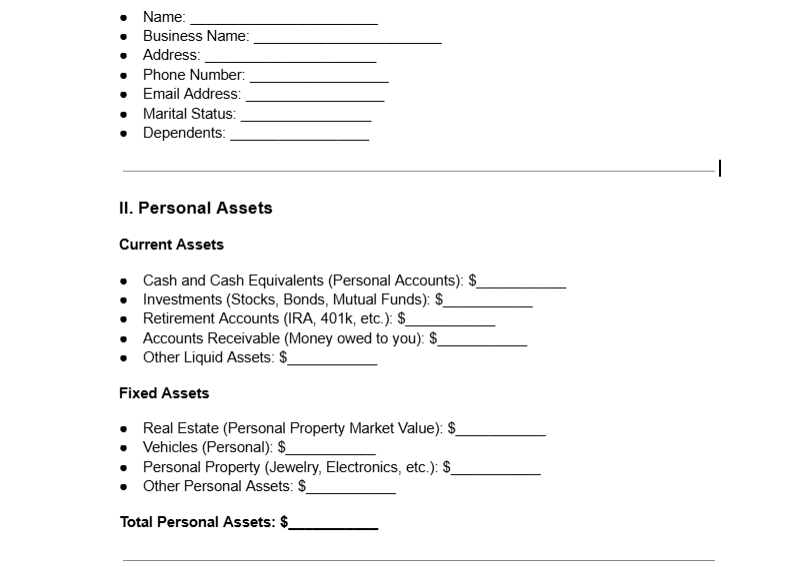

1. Basic Financial Statement Sheet

This straightforward template allows you to manually input all your financial information. It’s simple and easy to use. Just click the link below, and you’ll be prompted to make a copy.

Personal and Business Financial Statement

2. Custom Spreadsheet with Automatic Calculations

If you prefer a more automated approach, just enter your financial details, and the built-in formulas will calculate everything for you. Click the link below to access the template, and you'll be prompted to make a copy.

When to Update Your Statement

Update this financial statement at least once a year or after significant financial changes, such as:

- Major purchases or asset sales (e.g., buying new equipment or selling property)

- Business expansions or restructuring

- Large changes in income or expenses

- Any personal or business loans, refinancing, or other debt adjustments

- Changes in investments, such as retirement funds or stock portfolios

For the most accurate representation, update this statement quarterly or semi-annually if possible, especially if your business or personal finances fluctuate frequently. This will ensure you're always prepared to make sound financial decisions.